Retirement? Use Our Financial Planning Services

![]()

Our financial planning services

- Individuals or Families who have built a net-worth of over one-million dollars (excluding primary residence).

- Who are preparing for or currently in retirement, managing an inheritance, or navigating divorce later in life.

- Who value being as efficient as possible with their wealth and taxes.

![]()

Through financial planning, here are the different steps we take to add value to you:

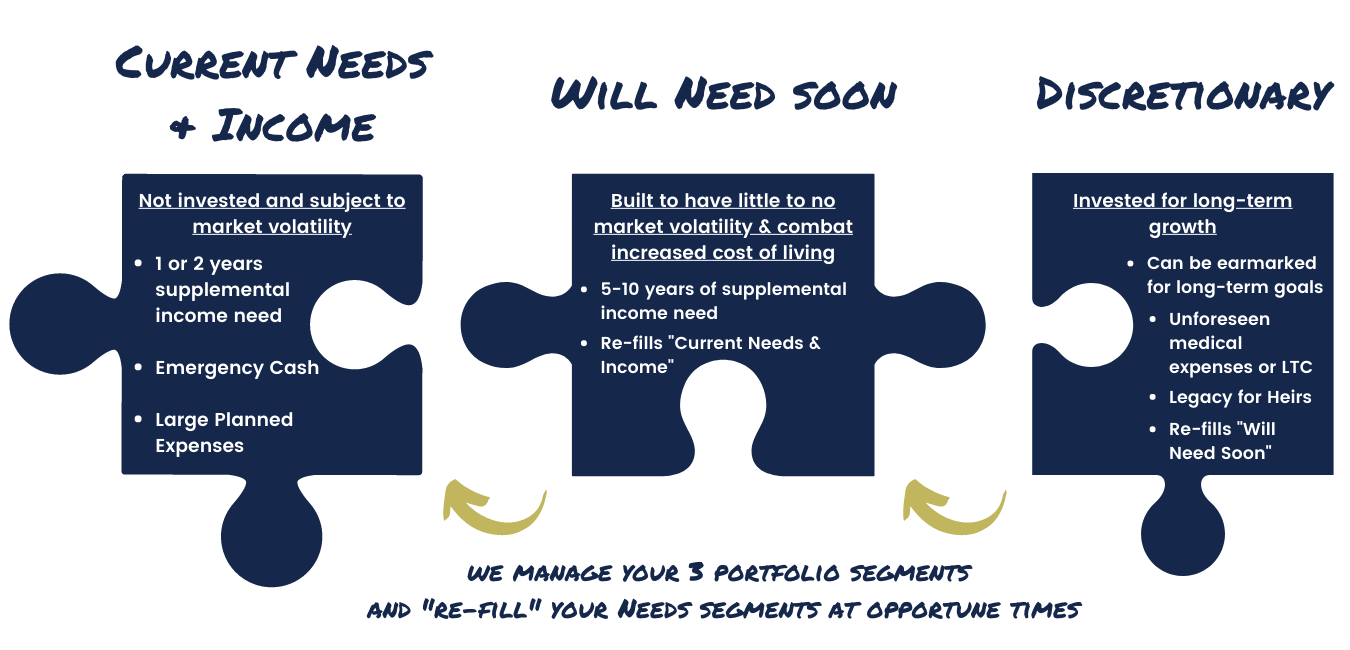

We implement strategies that can help you feel the same level of confidence about your income in retirement as you felt while working.

Enlarge Graphic

How we can help:

- We work with you to identify your supplemental income need.

- Identify which of your assets (i.e., cash, IRA, 403(b)/401(k), trust accounts, real estate, etc.) in your overall portfolio go in which "buckets", and why (asset location).

- Design an income stream to be as tax efficient as possible given your circumstances. This can help you maximize the amount of money you spend and preserve your nest egg.

- Our goal is to automate the entire process so you don’t have to worry about how or when you will get a retirement paycheck.

- Monitor the strategy on an ongoing basis and make adjustments when necessary. Your plan WILL CHANGE over time.

What you get:

- Simplified financial strategies to help you avoid outliving your money

- Help you prevent damaging investment decisions

- More confidence in retirement

- Comfort in retirement. Control of your strategy.

No strategy assures success or protects against loss

Click here to:

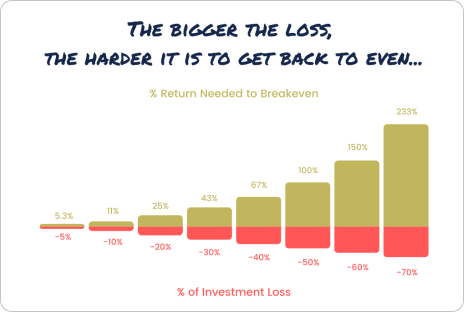

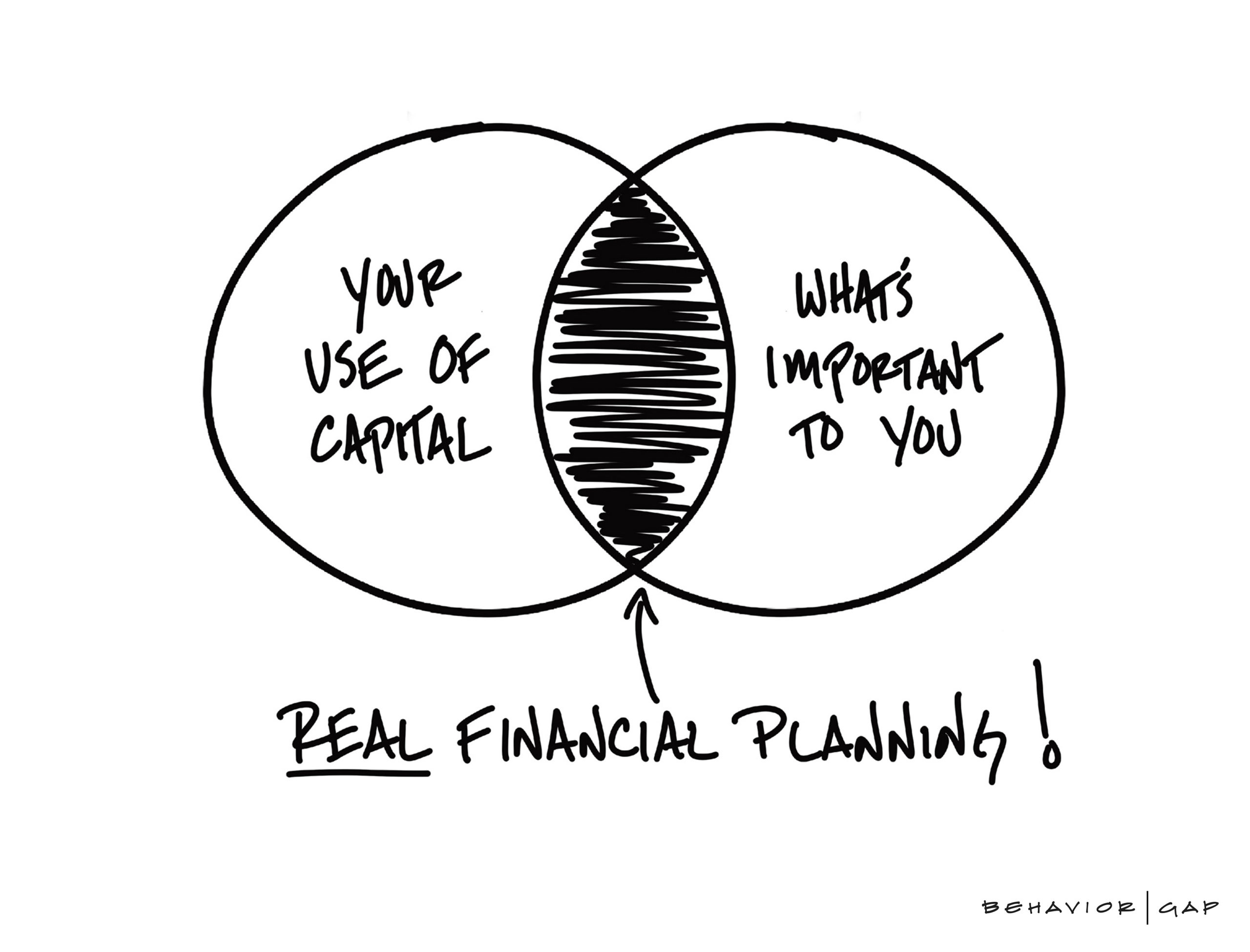

Our approach to investing is to keep it simple and have a purpose.

We operate on the mindset of "win more by losing less".

Successful investing is not just about what happens when times are good, but more so what happens when times aren't so good:

How We Can Help:

- Focus on your wants and needs to identify a purpose for your different investments

- Identify the amount of risk that is required to meet your needs, and how to control that risk

- Detailed planning for potential equity compensation, including RSUs, ESPP, ISOs, NSOs, etc.

- Allocate your investments accordingly and in the most tax-efficient manner for your situation

- Maintain investment strategy and take advantage of investment planning opportunities on an on-going basis

What you get:

- Simplicity that allows for better understanding and transparency of your investments

- Our firm's ongoing investment research and due diligence

- Diversification across your entire net worth

- Clear and understandable account reporting

- No more valuable time spent researching and reading "investing" articles

Click here to:

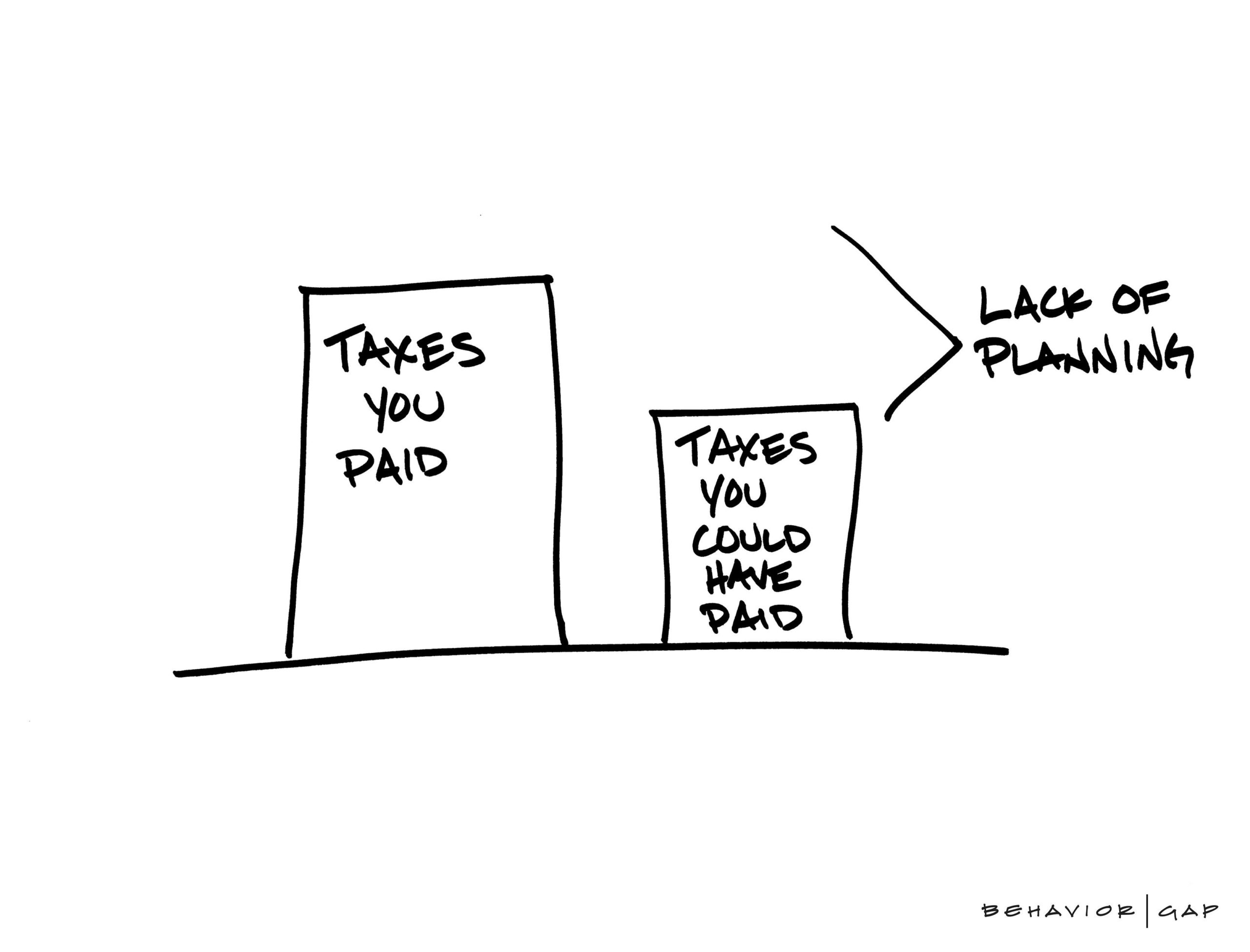

Tax reduction planning is looking ahead in order to develop strategies to reduce the amount of taxes you pay in the years to come. This allows you to keep more money in your pocket to tip your server, and not the IRS.

Believe it or not, there are common situations where you may be subject to a higher tax liability in retirement than you did while working.

Our forward looking tax planning compliments what many licensed tax preparers provide, which is checking the "rear-view mirror" to help you properly file what has already happened in the years prior.

How We Can Help:

- Review tax returns on an annual basis to identify opportunities for reducing your tax bill

- Assess new tax law changes and how they may affect your situation

- Help you mitigate hidden taxes and surcharges from Social Security and Medicare

- Coordinate the timing of your different income streams and retirement account withdrawals

- Identify when to recognize gains and losses in taxable portfolios (gain/loss harvesting) annually for potential tax savings

- Locate the appropriate location for investable assets to maximize tax-efficiency (i.e., hold a particular investment in retirement account or trust account?)

- Annual assessment of additional tax saving strategies such as Roth conversions, accelerating retirement withdrawals, increasing retirement deferrals, charitable giving, etc.

What you get:

- Coordination between your financial planner and tax preparer

- Potential tax savings for years to come

- Relief, by having an expectation of your taxes each year in retirement - No surprises!

Click here to:

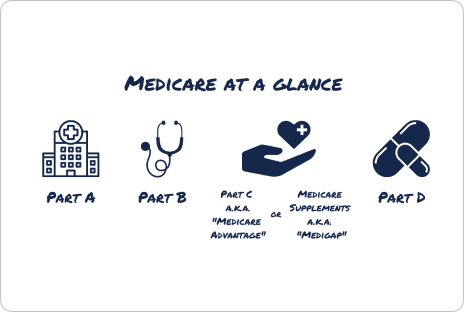

Social Security and Medicare eligibility represent two of the biggest milestones around retirement.

The two systems are vast and complex and require significant time to make a well-informed decision. Often times the decisions you make are permanent and therefore should be made only after comprehensive planning has taken place.

How We Can Help:

- Review your Social Security benefits and determine the optimal time to start collecting based on your family situation, potential outcomes, and preferences

- Identify how your Social Security benefits work with or against your other income sources

- Walk you through exactly how to sign up for Social Security, and things to consider when interacting with the Social Security Administration

- Help you understand the various components and costs of Medicare (Medicare Advantage, Medicare Supplements, Part A, Part, B, Part D)

- Review potential retiree health plan coverage from a previous employer and how that will interact with Medicare

- Identify the appropriate timing to enroll in Medicare and its various parts for your specific situation

- Walk you through exactly how to sign up for the various components of Medicare

What you get:

- Professional assistance when making some of life's largest and permanent decisions

- A Social Security strategy that pieces together with your various income sources and family dynamic

- Thorough understanding of Medicare and its various costs to make an informed decision

- Health care cost expectations and affordability throughout retirement

- Confidence about your Social Security and health care decisions in retirement

If Medicare Supplements a.k.a. Medigap fits your plan best, we can shop various carriers for you and help you enroll rather than have to send you elsewhere.

Click here to:

We want you to leave a legacy that you're proud of. Whether that is financially based, or based upon family memories and experiences, we can help you design an estate plan that leaves no one in the dark.

How We Can Help:

- Identify what is most important to you in life, and what about money is important to you and your family

- Identify any gaps in your overall plan that could have an adverse financial impact on your spouse, children, or other heirs

- Consider your and your spouses' overall health situation, and the survivor's financial circumstances in the event of an untimely death

- Assess your overall financial risks and identify gaps where various insurance coverages may be needed (disability, life, long-term care)

- Annual review of beneficiary designations

- Review "titling" of various investments or assets

- Review of POAs, health directives, wills, and trusts

What you get:

- Preservation of your overall net worth in order to provide for those you love

- Understanding of what to look for and consider when settling the estate of a loved one

- Coordination between your financial planner and estate planning or elder law attorney

- A Financial planner who can work with various corporate trustees when appropriate

- Clarity on how your legacy will positively impact those you love after you're gone

If an appropriate need for disability coverage, life insurance, or Long-term care coverage is identified in order to mitigate a substantial risk to your financial plans, we can shop the market for the best policies and prices for you rather than have to send you elsewhere.

Click here to: